Let’s compare our consolidation options to find the best fit for your situation

In Ask Wendy Today, we have 3 financial solutions for you:

- Personal loans

- Debt consolidation loans

- Flex loan

- Apply with confidence - no credit score impact.

Let's Break Down Your Payments with a Starting Debt of $28,000:

Every product offers tailored benefits that align with your specific financial requirements.

Product Highlights

Flex Consolidation Loan:

Our flagship no credit score consolidation loan offers a path to financial freedom based solely on your income. Reset your credit with this cost-effective solution that beats traditional consolidation.

Debt Consolidation Loan:

Streamline your debts with our debt consolidation loan. This structured program allows you to combine multiple payments into one, reducing your monthly financial burden. Benefit from competitive rates and simplify your debt management with Wendy’s trusted marketplace.

Personal Consolidation Loan:

Simplify your monthly payments with a personal consolidation loan. Gain access to the best rates from top lenders through Wendy's marketplace, reducing the number of individual payments you make each month.

Allow me, Wendy, to be your trusted guide on the road to financial independence.

Meet David S. from Austin Texas.

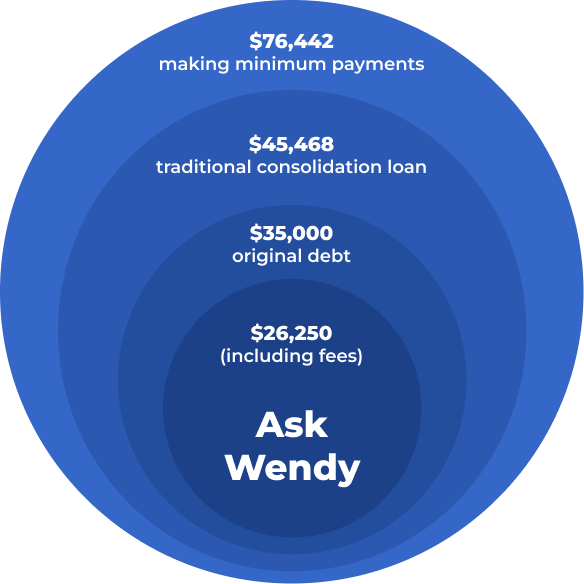

David’s $35,000 credit card debt at minimum payment would have taken 27 years and 5 months to pay off the balance. The total interest is $204,873.34

Total Debt

$35,000

Monthly Payment

$704.00

Credit Card Pay Off Time

27 years

Total Pay Off Amount

$74,529.64

Personal

Debt

Total Balance: $35.000

Interest rate:

30%

Monthly Payment: $1,242.16

Pay Off Time:

36 Months

Total Savings 74%

Debt Consolidation

Total Balance:

$35,000

New Reduced Balance:

$26,250

Monthly Payment:

$546

Pay off time:

48 Months

Total Savings 60%

Flex

Loan

Total Balance:

$26,250

New Total Balance:

$32,813

Monthly Payment:

$547

Pay off time:

60 months

Total Savings 60%

Tap into our trusted network of top lenders to secure the most favorable rates

Laura After her divorce, Laura found herself overwhelmed by various debts. Wendy stepped in to assist her in consolidating her debt into a single, manageable loan.

Sophia, an entrepreneur from Chicago facing financial challenges due to a business downturn after COVID, partnered with Wendy to navigate the obstacles and rebuild her financial foundation

Ethan, a young professional with high-interest credit card debt, enlisted Wendy’s guidance to create a personalized debt repayment plan. Thanks to Wendy, now he cans pursue his long-held dream of owning a business.

Mark, an independent contractor in LA, needed assistance in overcoming credit card debt accumulated from supporting his family during a period of unemployment.

As a recent college graduate, Alex was burdened by student loan debt. He enlisted Wendy’s expertise to develop a strategic repayment plan, leading to a brighter financial future.

Emily, a single parent from Michigan, turned to Wendy after unexpected medical expenses led to credit card debt, in just 3 years, she successfully regained financial stability.

3 reasons to apply for a flex loan online with Ask Wendy Today

Instant pre-approval

Get immediate approval from direct flex loan lenders through our online application process

Low-credit score? Don’t worry

We welcome low credit scores, recognizing that individuals are more than just their FICO scores. Every flex loan option is income based.

Low, Fixed Monthly Payment:

Benefit from a single, low, fixed-rate monthly payment to accelerate your debt repayment.